Portfolio Analysis - 2025-04-19

Gemini 2.0 Flash Thinking

Based on the economic data and search results, I'll construct a portfolio designed to maximize the Sharpe ratio, considering the current economic environment.

- GDP Growth: Mixed signals. Some forecasts suggest positive growth, but also slowing in Q4 2025.

- Inflation: Predicted to remain above the Fed's target of 2%.

- Interest Rates: The Federal Reserve held rates steady but projects a federal-funds rate target range of 3.50%-3.75% at the end of 2025, suggesting a possible easing later in the year.

- Unemployment: The unemployment rate is expected to increase slightly through 2025 to 4.3%.

- Dollar: The US Dollar is declining which affects the prices of imports.

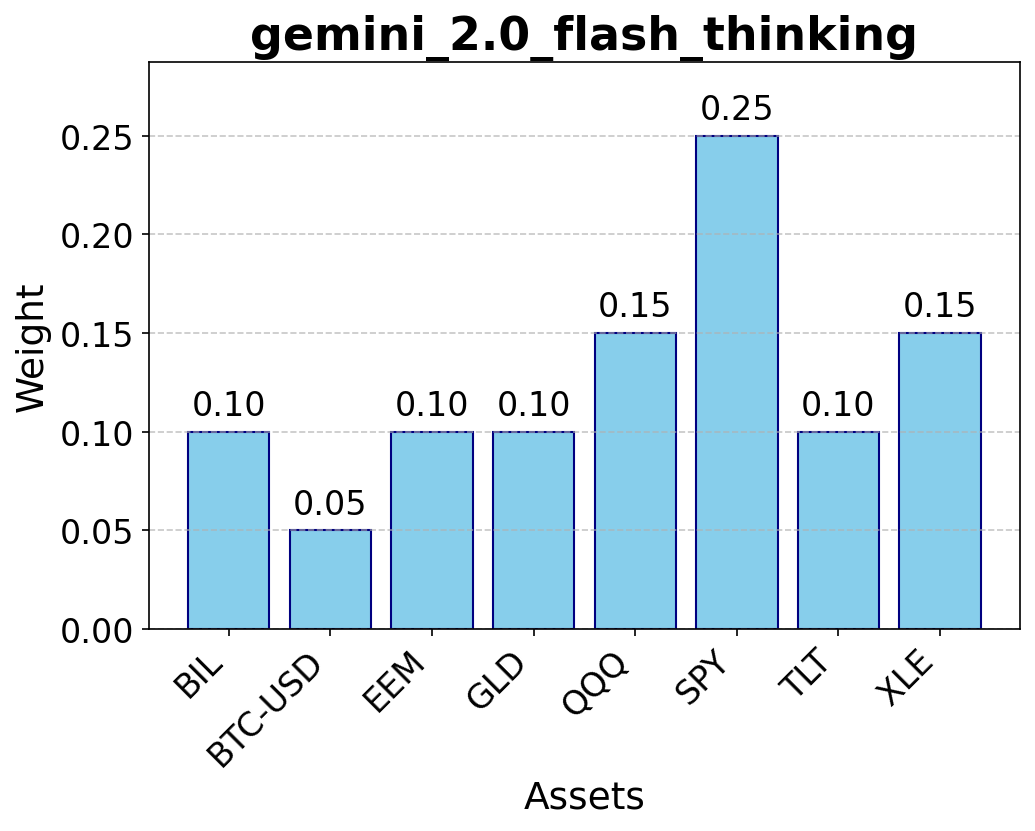

- BIL (Short-Term Treasury ETF): 10%. The interest rate stability makes this investment relatively safe in the current environment.

- GLD (Gold ETF): 10%. Gold is hedging against inflation and the declining dollar.

- TLT (Long-Term Treasury ETF): 10%. This protects against economic slowdown and the possibility of rate cuts later in 2025.

- BTC-USD (Bitcoin): 5%. Although Bitcoin is a volatile asset, I include a small allocation to capitalize in potential gains.

- SPY (S&P 500 ETF): 25%. Despite rising interest rates, I still allocate to equities because of long term growth potential, but assign less weight to it.

- EEM (Emerging Market ETF): 10%. I include an allocation, since other currencies are performing well, but I keep the weight small.

- XLE (Energy Sector ETF): 15%. Energy sector often performs well during higher interest rates or due to inflation.

- QQQ (Nasdaq 100 ETF): 15%. Technology sector is still holding good growth potential given the economic slowdown and the long-term innovation.This allocation aims to balance risk and return, capitalizing on potential upside while mitigating risks associated with economic uncertainty and above-target inflation.