Portfolio Analysis - 2025-04-18

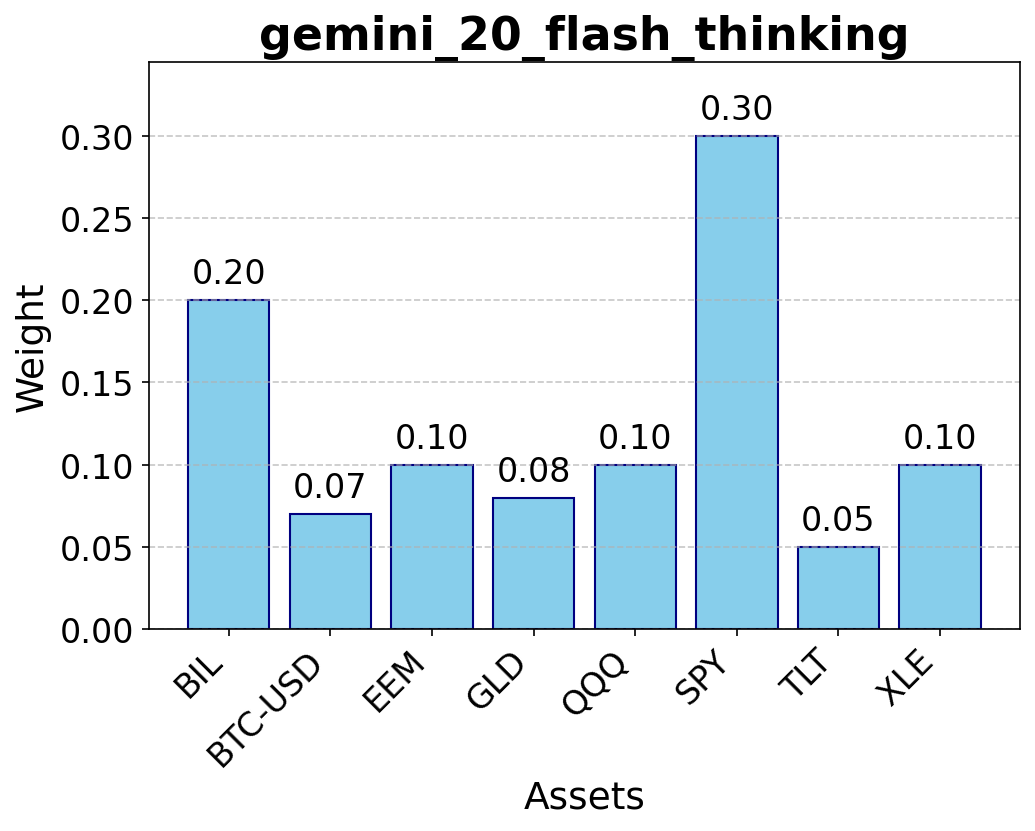

Gemini 20 Flash Thinking

Based on the gathered information, I am creating a probabilistic forecast to allocate the assets.

Economic Outlook: The US economy is expected to experience modest growth in 2025 with varying forecasts. Inflation is expected to remain elevated above the Fed's target. The unemployment rate is expected to increase slightly.The Federal Reserve is currently holding steady on interest rates, but the situation is dynamic due to expected economic conditions and also considering new policy initiatives.

- BIL (Short-Term Treasury ETF): This is considered a low-risk, stable investment. The current yield is attractive at 4.33% and it is expected to be stable.

- GLD (Gold ETF): Gold is seen as a hedge against inflation, and the current high prices could decrease if inflation expectations recede.

- TLT (Long-Term Treasury ETF): With the current yield curve close to inversion, the potential of returns may be limited. I anticipate a slight increase in the yield, potentially impacting its value negatively.

- BTC-USD (Bitcoin): Bitcoin is a volatile asset with a wide range of predicted prices. The news is constantly evolving and it has potential upside as well as downside.

- SPY (S&P 500 ETF): Analysts have a 'Moderate Buy' rating, indicating a positive outlook.

- EEM (Emerging Markets ETF): It has a 'Moderate Buy' rating. Emerging markets can offer higher growth potential but also carry higher risk.

- XLE (Energy ETF): XLE has a 'Moderate Buy' rating. The economic reports suggest that it can perform well during these conditions.

- QQQ (Nasdaq 100 ETF): QQQ has a 'Moderate Buy' rating. Tech stocks are still a good investment in the current market.

- Conservative Approach: Given the current economic environment, which includes elevated inflation and some uncertainty, I adopt a moderately conservative approach emphasizing stability and income while also allocating for growth.

- Diversification: I diversify across asset classes to manage risk. I have adjusted the forecast for assets based on the information obtained.

Assumptions and Rationale: I assume that the current trend of economic conditions will persist in the market, and I am making my investment decisions based on the information I have gathered. I believe that a balanced portfolio with income-generating assets, a hedge against inflation, and growth potential is well-suited for the current economic conditions.