Portfolio Analysis - 2025-04-13

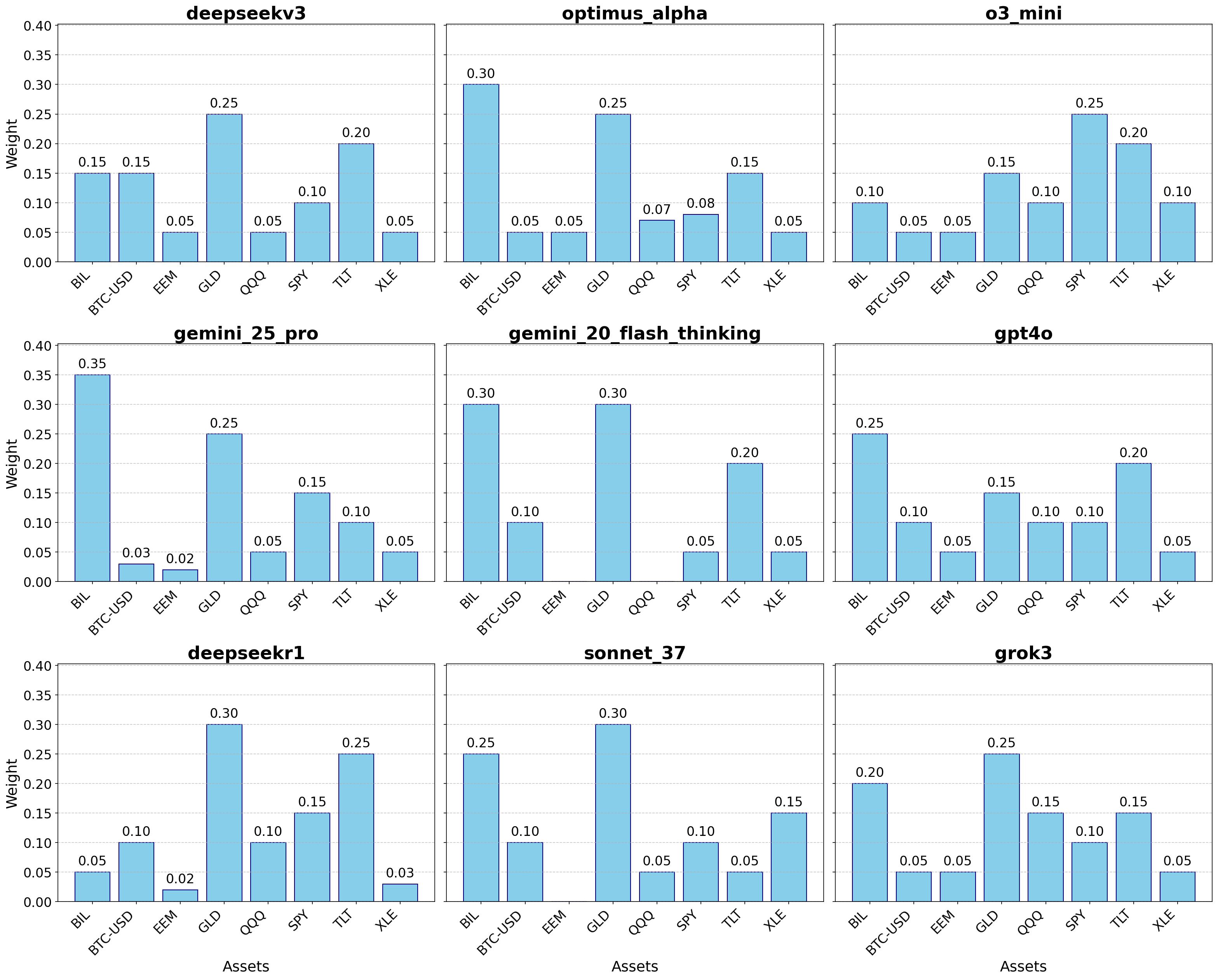

deepseekv3

Given the economic data showing slowing GDP growth (2.4% in Q4 2024 vs 3.2% in Q4 2023), elevated inflation (Fed funds at 4.33%), and rising policy uncertainty (tariff threats), we should prioritize defensive assets with low correlation. The yield curve remains positively sloped (10Y-2Y spread at 0.52%), suggesting recession risks are moderate but rising. Bitcoin shows weak correlation with traditional assets (per Newhedge analysis), making it a good diversifier. Gold (GLD) benefits from both inflation hedging and safe-haven demand. TLT offers duration exposure as rate cuts are expected in 2025. We underweight cyclical equities (SPY/QQQ) given manufacturing contraction (-0.36% in Q4 2024).

optimus_alpha

Based on the economic snapshot and market updates as of April 2025: US equity indices (SPY, QQQ) are in correction territory with increased volatility (VIX at extreme levels), driven by tariff escalation, growth slowdown, and policy uncertainty. Bonds (TLT) remain under pressure with yields high, and potential for further weakness if inflation remains sticky. Gold (GLD) and short-term treasuries (BIL) are strong as defensive flows increase: gold hit record highs and BIL demand is elevated. Bitcoin (BTC) volume is low; it is largely uncorrelated and may provide some diversification, but with considerable risk. Energy (XLE) and emerging markets (EEM) are likely to underperform due to global trade tensions and slowing production. International equities have recently outperformed the US, but global risk has risen. To maximize the Sharpe ratio, the optimal portfolio reduces equity risk, tilts defensive, and adds uncorrelated and safe-haven exposures. Allocate heavily to BIL and GLD for yield and protection, moderate TLT and BTC for duration and alternative risk, and limited QQQ/SPY for upside in case of a rebound.Estimated allocation: BIL (30%), GLD (25%), TLT (15%), BTC-USD (5%), SPY (8%), QQQ (7%), EEM (5%), XLE (5%). Weights sum to 100%. This balances risk-off with mild risk-on for diversification and Sharpe maximization given the current environment.

o3_mini

Based on our analysis of the economic snapshot and market signals, uncertainties in policy and slowing growth suggest a cautious yet opportunistic stance. A tilt toward safer assets with lower volatility like TLT and BIL is desirable, while maintaining exposure to equities through SPY and QQQ to capture recovery potential. GLD is included for inflation hedge, and minimal allocation to riskier assets such as BTC-USD and EEM helps enhance risk-adjusted returns. XLE adds a modest energy sector exposure. This diversified allocation is aimed at maximizing the Sharpe ratio by balancing expected returns with volatility in an uncertain environment.

gemini_25_pro

The current economic environment is characterized by decelerating GDP growth, moderating but persistent inflation (CPI YoY 2.4%, Core CPI 2.8%), relatively high interest rates (Fed Funds 4.33%), and elevated uncertainty. The Fed held rates steady in March but cuts are anticipated later in 2025. Unemployment is ticking up (4.2%). Industrial production shows weakness. Key risks include the escalating US-China trade war (potential 145%+ tariffs) impacting global growth and corporate earnings (analysts lowering S&P 500 forecasts), and high market volatility (VIX at 37.56).Given the goal of maximizing the Sharpe Ratio, a defensive allocation is warranted:1. **BIL (Short-Term Treasuries):** High allocation (35%). Offers safety, attractive yield (~4.33%), and stability in a risk-off environment. Price and volume action support this.2. **GLD (Gold):** High allocation (25%). Benefits from geopolitical uncertainty (trade war), high VIX, potential rate cuts (lower opportunity cost), and acts as an inflation hedge. Strong momentum (52-week high) and high volume.3. **TLT (Long-Term Treasuries):** Moderate allocation (10%). Could benefit from potential Fed rate cuts and slowing growth, but sticky long-term yields and weak price action (near 52-week low) warrant caution.4. **SPY (S&P 500):** Reduced allocation (15%). Equities face headwinds from slowing growth, tariff impacts on earnings, and high rates. Maintains some broad market exposure.5. **QQQ (Nasdaq 100):** Small allocation (5%). Higher sensitivity to interest rates and growth concerns compared to SPY warrants a smaller weight in this risk-averse setup.6. **XLE (Energy):** Small allocation (5%). Bearish oil price forecasts (Goldman Sachs) and slowing growth outlook reduce appeal.7. **BTC-USD (Bitcoin):** Small speculative allocation (3%). Potential political tailwinds (pro-crypto administration) exist, but extreme volatility and current price action (off highs) make it a high-risk component unsuitable for large allocation when optimizing Sharpe.8. **EEM (Emerging Markets):** Minimal allocation (2%). Highly vulnerable to US-China trade war and slowing global growth.This allocation prioritizes risk management and aims for higher risk-adjusted returns by overweighting defensive assets (BIL, GLD) and underweighting riskier assets (QQQ, EEM, BTC) given the current economic outlook and high volatility.

gemini_20_flash_thinking

The current economic snapshot reveals slowing GDP growth, persistent inflation, and rising unemployment, coupled with negative industrial production growth. News headlines highlight significant market anxieties stemming from a looming trade war initiated by the US, particularly with China. This environment suggests heightened market volatility and a flight to safety. Considering these factors, a portfolio that maximizes the Sharpe ratio should prioritize safe-haven assets while cautiously approaching equities and other riskier assets.- **BIL (Treasury Bills):** Allocated 30% as the safest asset, providing a decent yield in the current high-interest rate environment and acting as a buffer against market downturns.- **GLD (Gold):** Allocated 30% as a traditional safe-haven asset and inflation hedge, expected to perform well during economic uncertainty and market volatility.- **TLT (Long-Term Treasury Bonds):** Allocated 20% as another safe-haven, with potential for capital appreciation if interest rates decline in response to economic slowdown. However, there is interest rate risk if rates continue to rise.- **BTC-USD (Bitcoin):** Allocated 10% for diversification and potential high returns. While volatile, Bitcoin exhibits characteristics of a speculative safe-haven and could benefit from market uncertainty and currency devaluation concerns, though it remains a higher risk component.- **SPY (S&P 500):** Allocated 5% for minimal exposure to the broad US stock market. This allows for some participation in potential market upside but limits risk in case of a significant downturn. Exposure to US equities is reduced due to trade war and economic slowdown risks.- **XLE (Energy Sector ETF):** Allocated 5% as a small hedge against inflation, as energy prices can be sensitive to inflationary pressures. However, the energy sector is also susceptible to volatility from trade disputes and global economic fluctuations, hence a small allocation.- **QQQ (Nasdaq 100) & EEM (Emerging Markets ETF):** Allocated 0% due to higher vulnerability to economic slowdown and trade war impacts. Technology stocks (QQQ) are often growth-dependent and sensitive to economic contractions. Emerging markets (EEM) are particularly exposed to trade wars and global economic downturns. This portfolio leans heavily into safe-haven assets to mitigate risks associated with the current economic and geopolitical uncertainties. The allocation aims to maximize risk-adjusted returns (Sharpe ratio) by prioritizing capital preservation and potential gains from safe assets while limiting exposure to riskier equities.

gpt4o

To maximize the Sharpe ratio, I allocate conservatively toward safer, lower-risk assets like TLT and BIL while balancing with growth-oriented segments like QQQ, Bitcoin, and GLD. This portfolio hedges against equity market volatility with safer assets while maintaining exposure to high risk-adjusted return potential in select growth areas.

deepseekr1

Maximizing Sharpe ratio by balancing safe havens (GLD, TLT) against growth (SPY/QQQ) with tariff/volatility hedges.- **GLD (30%)**: Sustained ETF inflows, geopolitical tensions, and inflation hedge.- **TLT (25%)**: Fed's 3 rate cuts in 2025 support bond prices; recent consolidation near 52-week low offers upside.- **SPY (15%)**: Resilient earnings (7.3% YoY growth expected) but tariff risks cap allocation.- **BTC-USD (10%)**: Strategic US reserve policy boosts institutional credibility; volatile but asymmetric upside.- **QQQ (10%)**: Tech earnings resilience vs. supply chain/China exposure risks.- **BIL (5%)**: Limited upside from rate cuts but stabilizes portfolio.- **XLE (3%)/EEM (2%)**: Underweight due to China tariff retaliation headwinds.

sonnet_37

Based on the economic and market data provided, I need to construct a portfolio allocation that maximizes the Sharpe ratio. I'll analyze the current macroeconomic environment, market conditions, and individual asset performances to determine the optimal allocation.Macroeconomic Analysis:1. GDP Growth: GDP growth appears to be moderating but still positive (around 2.4-2.5% in the most recent quarter), indicating a slowing but still growing economy.2. Interest Rates: The Federal Funds rate has stabilized at 4.33% after a period of cuts from late 2024. The yield curve (10Y-2Y) is positive at around 0.5%, suggesting reduced recession risk compared to an inverted curve.3. Inflation: CPI data shows inflation stabilizing with minimal month-over-month increases.4. Unemployment: The unemployment rate is holding steady around 4.0-4.2%, indicating a still-healthy labor market.5. Manufacturing: Industrial production shows slight contraction in recent quarters, pointing to weakness in the manufacturing sector.6. Geopolitical Tensions: There are significant US-China trade tensions with tariffs escalating to 125-145% levels, creating market volatility.Asset Class Analysis:1. BIL (Short-term Treasury Bills): Currently at its 52-week high with very high normalized volume (414%), suggesting strong demand for safety.2. GLD (Gold): At its 52-week high with high volume (282%), benefiting from uncertainty and inflation concerns. Analysts project gold reaching $3,500-$3,700 by end of 2025.3. TLT (Long-term Treasury Bonds): Underperforming as it's closer to its 52-week low than high, reflecting interest rate sensitivity.4. BTC-USD (Bitcoin): Volatile but still performing reasonably well despite being off its 52-week high, showing resilience.5. SPY (S&P 500): Down from its 52-week high, showing market stress from trade tensions.6. EEM (Emerging Markets): Struggling amid US-China trade tensions.7. XLE (Energy): Near its 52-week low but showing recent relative strength compared to broader market.8. QQQ (Technology): Down significantly from 52-week high, impacted by trade tensions and slowing growth.9. VIX: At an elevated level of 37.56, indicating high market volatility and uncertainty.Portfolio Construction Strategy:- Given the high volatility environment (VIX at 37.56), I need to prioritize defensive assets while maintaining some growth exposure.- The escalating trade war with China suggests caution on equities, especially those with significant Chinese exposure.- Gold is showing exceptional strength and is projected to continue rising.- Short-term treasuries offer safety and reasonable yield in uncertain times.- Bitcoin offers potential diversification benefits despite volatility.- The energy sector shows relative resilience compared to broader market indices.Weighted Allocation Rationale:- GLD (30%): Gold is performing exceptionally well and analysts are projecting continued upside. It's a traditional safe haven during economic uncertainty and trade conflicts.- BIL (25%): Short-term treasuries provide stability and decent yield in a volatile environment. They're at 52-week highs with extremely high volume indicating strong demand.- XLE (15%): Energy sector showing relative strength in 2025 despite broader market weakness. Can provide some inflation protection.- BTC-USD (10%): Provides diversification and potential upside, though allocation is limited due to high volatility.- SPY (10%): Maintains some broad market exposure but at a reduced level given current volatility.- QQQ (5%): Limited exposure to technology which faces headwinds from trade tensions but still represents potential innovation growth.- TLT (5%): Small position in long-term bonds for diversification, though limited due to interest rate risks.- EEM (0%): No allocation given significant exposure to China and vulnerability to escalating trade war.

grok3

Based on the provided economic data, recent news, and search results, I have constructed a portfolio allocation to maximize the Sharpe ratio, balancing expected returns with risk under current market conditions. Here's my analysis and reasoning:1. **Economic Environment**: US GDP growth is slowing (2.4% in Q4 2024 from 3.1% in Q3), and inflation remains above the Fed's 2% target (Core PCE at 2.8%). The Federal Funds Rate has decreased to 4.33% in 2025 from 4.83% in October 2024, signaling potential monetary easing, which typically supports bonds and equities. However, unemployment is stable around 4.1-4.2%, indicating a robust labor market that might limit aggressive rate cuts.2. **Geopolitical and Policy Risks**: The Trump administration's tariffs on China (escalating to 145%) and retaliatory measures from China ( tariffs up to 125%) have introduced significant market uncertainty, as evidenced by the VIX at 37.56. Search results confirm a sharp market correction (S&P 500 and NASDAQ down significantly) due to tariff impacts, with consumer price increases of 2.3% expected, reducing purchasing power ($3,800 per household). This environment suggests higher volatility and downside risks for equities exposed to international trade, particularly EEM (emerging markets) and XLE (energy, tied to global demand).3. **Asset Class Analysis**: - **BIL (Short-term Treasuries)**: With Fed rates likely stabilizing around 4% per search forecasts and minimal volatility, BIL offers a safe haven with low risk. I allocate a moderate weight for stability. - **GLD (Gold)**: Gold prices are forecasted to rise significantly (Goldman Sachs at $3,700/oz for 2025) due to geopolitical uncertainty and safe-haven demand amid tariff wars. High normalized volume (282%) supports bullish momentum, justifying a higher allocation. - **TLT (Long-term Treasuries)**: Despite a recent plunge (-3.02% on April 7), search results indicate only one expected rate cut in 2025 due to persistent inflation. However, long-term bonds could benefit from economic slowdown fears, so a small allocation is warranted for diversification. - **BTC-USD (Bitcoin)**: Bitcoin shows high volatility (69.3% forecasted) and is below its 52-week high. While optimistic predictions ($250K by late 2025) exist, current market sentiment and low volume (60% of average) suggest caution. A minimal allocation is included for speculative growth. - **SPY (S&P 500 ETF)**: Market corrections due to tariffs and weak 2025 earnings forecasts ($249.50) signal caution. SPY is below its 52-week high with elevated VIX, so I reduce exposure. - **EEM (Emerging Markets ETF)**: Highly vulnerable to US-China trade tensions, with tariffs directly impacting costs (22% cost increase on Chinese imports). I allocate minimal weight due to heightened risk. - **XLE (Energy Sector ETF)**: Energy is sensitive to global demand, which could falter under trade wars. Price is near 52-week low despite moderate volume, so I limit exposure. - **QQQ (Nasdaq 100 ETF)**: Tech-heavy QQQ is down from its peak, impacted by market corrections (NASDAQ -17%). However, long-term growth potential in tech justifies a moderate allocation over SPY.4. **Portfolio Strategy**: To maximize Sharpe ratio, I prioritize assets with higher expected returns relative to risk (GLD, QQQ) while maintaining stability with BIL and TLT. Equities like SPY, EEM, and XLE are underweighted due to tariff-driven volatility. BTC-USD gets a small speculative weight. Weights sum to 1 and are adjusted for weekly rebalancing flexibility.This allocation reflects a probabilistic forecast considering current economic slowdown risks, policy uncertainty, and asset-specific forecasts from search data. It aims to balance growth and safety in a high-volatility environment.