Portfolio Analysis - 2025-04-06_2

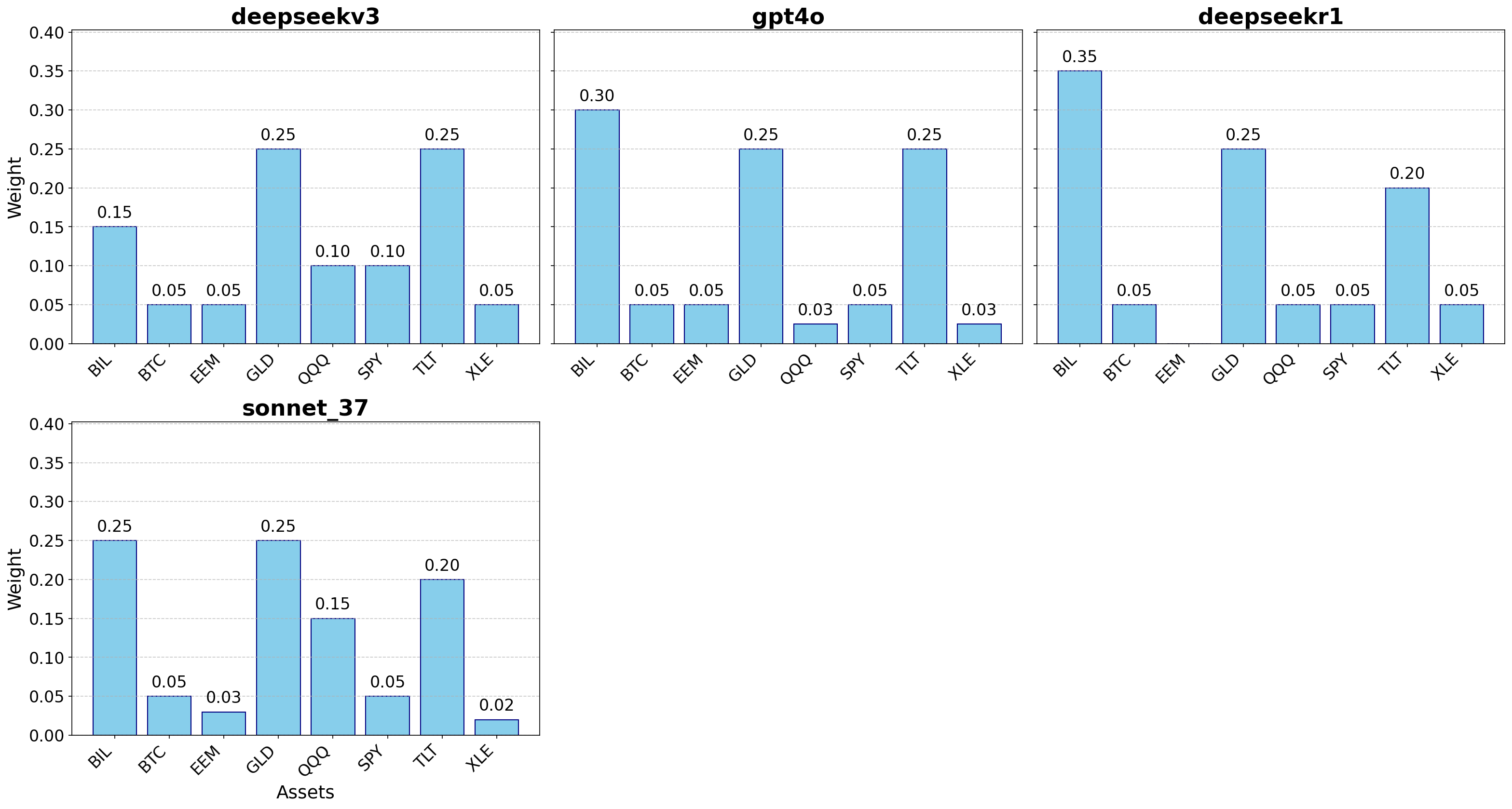

Deepseekv3

Given the economic uncertainty, trade tensions, and market volatility highlighted in the data, a defensive portfolio allocation is warranted. Gold (GLD) and long-term Treasuries (TLT) have shown resilience and are likely to continue performing well as safe-haven assets. The S&P 500 (SPY) and tech-heavy QQQ are under pressure due to tariffs and growth concerns, while emerging markets (EEM) and energy (XLE) face additional risks from global trade disruptions. Bitcoin (BTC) remains a speculative hedge but with high volatility.

---

Gpt4O

Given the current economic conditions, the allocation strategy should be defensive and risk-averse. The US economy faces high volatility and potential contraction due to tariffs and rising inflation. Stock market volatility is heightened, with indices like the S&P 500 (SPY) and Nasdaq (QQQ) showing downtrends. The VIX is high, indicating market nervousness. Bonds are relatively stable, and gold (GLD) is a traditional hedge against inflation and uncertainty. Therefore, the strategy will allocate more towards bonds (BIL, TLT) and gold (GLD), while keeping lower allocations to volatile assets like equities (SPY, QQQ, EEM) and speculative assets like BTC. Energy sector (XLE) exposure will be minimized due to uncertainty in industrial production.

---

Deepseekr1

Elevated recession risk (35% Goldman estimate) & yield curve inversion warrant defensive positioning. High VIX (30.02) and tariff-induced volatility favor safe havens. Rate cut expectations moderately support bonds. Manufacturing contraction (-0.36%) and trade war impacts suggest underweight cyclicals. Energy (XLE) held at 5% as contrarian bet given 52-wk low. BTC minimal allocation as unproven crisis hedge.

---

Sonnet 37

Based on the data and news provided, I need to craft a portfolio that accounts for the current market turmoil triggered by Trump's wide-ranging tariffs announced in early April 2025, which have caused major market disruption and recession fears.